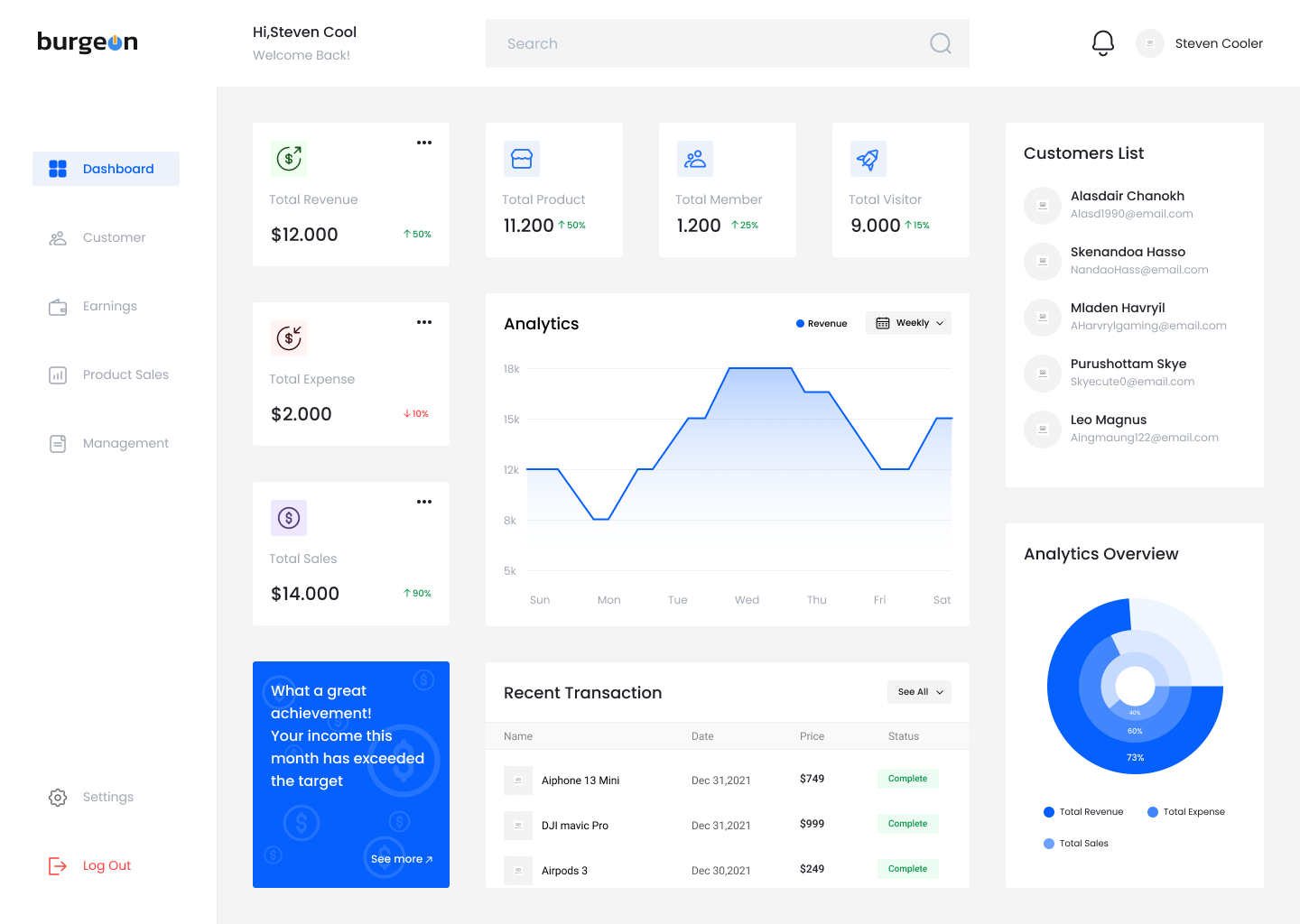

Corporate FD

Explore how our Wealth Management experts can help people, businesses and institutions build, preserve and manage their investments so they can pursue their financial goals.

Why Invest inFixed Deposits?

Like banks, several companies and NBFCs are also allowed to collect deposits for a fixed tenure at a prescribed interest rate. Such deposits are called corporate Fixed Deposits. Similar to banks they come with the assurance of guaranteed returns and flexibility of choosing the tenure. Plus, they provide a higher interest rate than banks do.

- Benefit 1: Interest Rates are Higher than Banks

- Benefit 2: Ideal for Short-Term Investments

- Benefit 3: Check Ratings before Investing in FD

- Benefit 4: Wide Variety of Investment Tenures

- Benefit 5: Tax Savings and other Deductions Possible

Stakeroot Services

How We Help

Our expert team helps you choose the right Corporate FD based on your financial assessment and short-term goals.

Professional Advice

We will provide you with the right option and tenure of Corporate FD after assessing and analyzing your needs

RiskFree Deposits

We only suggest deposits that have shown a past record of successful growth thus reducing your risk

Transparency

We always share our analysis and reason for choosing a particular deposit withour clients for their benefit

Choice Of Deposits

You have the freedom to choose from a variety of tenures such as, monthly, quarterly, half-yearly or yearly

Higher Returns

Unlike Bank FD's our chosen corporate deposits offer a much higher rate of returns as we choose them carefully

Over 1000 Clients rely on Stakeroot

Clients rated Stakeroot 4.9 out of 5 for “always putting my interests first”

Successful Investment is about managing risk not avoiding it

─ Benjamin Graham

Testimonials

What they say about us

Our clients have been our biggest cheerleaders. We have acquired over 150+ clients through reference alone and that says a lot!